18 Jan Why Don’t we Demand Zero Emissions, “Always On”, Affordable Power?

This article by James Fleay of DUNE – Down Under Nuclear Energy looks at investment in nuclear energy on the National Electricity Market.

Nuclear energy is clean, cheap, reliable and safe.

Like many advocates for nuclear energy in Australia, my colleagues and I believed that if the Federal Government would only repeal the ban on nuclear power, business or state governments would eagerly build nuclear power plants (NPPs) to rapidly cut emissions, reduce power prices and improve network reliability. In fact, this belief prompted the creation of DUNE a company formed to study the investment case and present the facts to politicians and power market participants.

After all, being thus informed, they would hasten to repeal said law…right? How wrong we were.

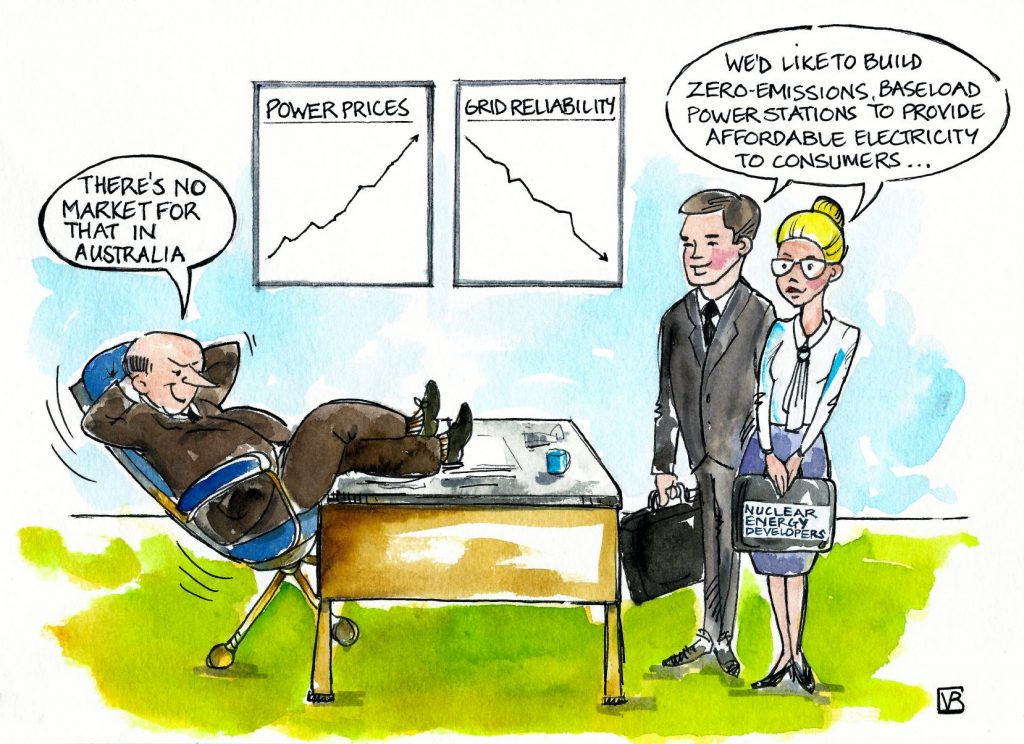

The federal ban is only the first challenge to deploying clean, cheap and reliable power in Australia. The second, and much bigger problem, is our liberalised, energy-only National Electricity Market (NEM) and the out-of-market subsidies that provide additional revenue to solar and wind generators. Dr Kerry Schott, the chief advisor the Energy Security Board (ESB) recently confirmed this in an article in The Australian. Among other things, she confirmed that the NEM was not functioning to attract much needed new investment in “always on” power generation. Despite high power prices and a need for investment in “always on” generation, our NEM market design will not support NPP investment[1].

For all their desirable attributes, a NPP involves a large, upfront expenditure to build the plant (CAPEX) and a long development period without revenue from sales. For simplicity, let us assume that the developer can access construction finance for a reasonably low rate and that the project delivery team are world class (no cost or schedule overruns). Let us also assume that modern small modular reactor (SMR) designs do result in faster, cheaper, and more predictable project delivery. So, in a market with high power prices, what else does a NPP developer need to make an investment decision?

Simple: The developer must know in advance that for at least the first 20 years of operation (preferably longer), the NPP will sell most or all its electricity for a given price. Because of the size of the investment and its time horizon, NPP developers cannot justify investment wholly exposed to merchant risk – the investment must be underwritten by contracted future production. This is the only way that any investment of this nature can be sanctioned, including LNG plants, petrochemical plants and any other capital-intensive utility or manufacturing facilities.

Of course, contracts that underwrite large CAPEX investments are more complicated than described above. Usually the “fixed price” is actually a price range that includes a ceiling to protect the buyer and a floor to protect the developer. Also, one developer may require as little as 70% of nameplate capacity be sold in advance, accepting merchant risk (spot price) for the other 30% whilst another developer may require that 100% of production is pre-sold. Various contractual mechanisms are used to protect both parties from credit risk, project risk, exogenous risk (i.e. future transmission constraints), regulatory risk and poor operational performance. Because the investment is fully or substantially protected from market risk, the contract price of the power can often be discounted to prevailing market rates as the risk premium implied in the hurdle rate can be reduced.

There are also obvious benefits to the buyer including long range price stability which may be needed to underwrite their own capital investments or safeguard operational viability (think steel and aluminium smelters).

As current generation capacity retires and provided there is a willing buyer, investments of this kind could make sense in markets with low price volatility, stable energy policy and well established, unchanging regulatory frameworks; none of which can be said about the NEM.

With regards to a privately funded NPP investment, indeed any large investment with a long project duration, the NEM has deficiencies which need to be addressed.

Volatility

In a normal market, the price signal = investment signal. However, as price volatility increases, the price signal becomes meaningless as an investment signal. Combined with persistent policy and regulatory change (including direct market intervention), high volatility leads to a complete investment freeze for assets that do not attract out-of-market revenue.

Note: This is not a criticism of the Federal Governments recent threats of market intervention, including building a combined cycle gas plant in the Hunter Valley. Unfortunately, these interventions are justified.

Of course, when average power prices get very high, some investors will be lured into the market despite the high volatility. Unfortunately, though rationally, these higher-risk investors have short time horizons and favour low upfront costs and quick deployment, even if they incur higher operational costs. Further, the technology must be optimised to take immediate advantage of high prices without being exposed to low or negative prices a few hours later (when the sun comes up or the wind begins to blow). This is one reason for the proliferation of small-medium, fast start open cycle gas turbines and reciprocating engines within the NEM, despite high gas prices. Even with high average prices, a high volatility market cannot support large private investments with long time horizons, nuclear or otherwise.

Another consequence of high price volatility is increased financialisaton[2] of the power sector, though the impact to power prices is difficult to quantify. I will cover this in a future article.

Subsidy Led Investment

Provided their production is not curtailed, solar and wind power generation assets can access additional revenue that, under current law, would not be extended to a NPP should the nuclear ban be lifted. These payments take the form of large generation certificates (LGCs) which, under the Renewable Energy (Electricity) Act 2000, liable entities (electricity retailers) are obligated to regularly purchase. These provide renewable generators with an additional $30 – $40/MWhr.

The result of this policy, indeed its very intention, is that investment for at least a decade has been nearly entirely focused on capturing these out-of-market subsidies – implications for system-level costs of electricity be damned!

Given their very low operating costs and non-existent availability obligations, this means that renewable generators can and do bid into the market at rates close to $0/MWhr or even negative because they receive guaranteed out-of-market revenue.

The Government has confirmed that this program will be ramped down as planned but the calls for its expansion and perpetuation may prove difficult for the PM and Energy Minister to ignore.

For nuclear power plants to be built in the NEM, they would require equal access to out of market payments. Alternatively, out of market payments would be abandoned in favour of carbon pricing.

The Value of Availability and Dispatchability

The NEM is what is referred to as an “energy only” market and, like its Texan counterpart, ERCOT, was conceived at a time when all sources of power generation, regardless of fuel type, had similar operating characteristics including availability and dispatchability. Because these qualities were intrinsic to all generators, there was no need to value these attributes separately nor much need to worry about short-run adequacy of supply.

Things began to change as the portion of intermittent renewable energy began to increase. Primarily because of their very low short-run marginal costs (and assuming no transmission constraints), renewable energy generators receive priority dispatch when they are available but have no obligation to maintain supply. Largely at the mercy of the market and the weather, network operators must quickly and at any price, find and dispatch alternative generation when renewable generators exit the grid to meet demand for electricity or blackouts will ensue. This scenario happens daily and usually results in periods of elevated prices as fast start, open cycle gas turbines (OCGT) are brought online. This is the very real cost of intermittency[3], which is not borne by renewable energy investors, but by energy consumers.

High penetration of intermittent renewable energy will always result in OCGTs being the marginal supply. Consequently, markets with very low gas prices, have reduced costs of intermittency (though the misallocation of precious gas resources is unforgiveable). In a market with high gas prices, such as Eastern Australia, the costs of intermittency are staggering.

So, if intermittency has a cost, does it follow that availability and dispatchability have economic value as characteristics of energy? Preeminent historian of energy, Vaclav Smil seems to think so. In Chapter 7 of his magisterial Energy and Civilisation: A History, Smil states

“Past adoptions of new energy sources and new prime movers could never have had such far-reaching consequences without introducing and perfecting new modes of harnessing those energies and controlling their conversion to supply required energy services at desirable rates” (emphasis added)

I have found that the value of constantly available energy is so obvious that non-technical people intuitively grasp it, though they often do not think about it or bother how the “miracle of the grid” is achieved[4].

In a collaboration with the Nuclear Economics Consulting Group, DUNE prepared a submission to the Energy Security Board (ESB) which outlined an alternative market structure that aligns incentives towards dispatchable, high availability generation technologies (or combinations thereof). Very simply, our proposal is for separate markets which use reverse auctions for “always on” and “intermittent plus firming” supply which are roughly proportional to the baseload and variable portions of the grid’s daily load profile and I will describe this proposal further in a future article.

Of course, there are already various measures used in other power markets throughout the world to incentivise availability and dispatchability. These include capacity markets, out-of-market capacity payments and others.

Regardless of the market design, no NPP (or other “always on” technology) will be built in a grid that does not confer a value to these critical attributes without which our modern, high-energy society would not be possible. In fact, there is not much incentive to properly maintain our nation’s existing “always on” assets.

Conclusion

If DUNE or others are ever to be successful in deploying nuclear energy in Australia, there are many obstacles that will need to be overcome and the investment case, for the investor and consumer alike is foremost among them. Simply pointing to low power prices in nuclear nations like France, Sweden and Ontario (Canada) and assuming the investment case will follow because of elevated power prices in the NEM does not recognise that the current design of the NEM will not support an NPP investment decision regardless of how high average power costs get.

But this realisation begs a further question; if a power technology is zero-emissions, unquestionably safe, “always on” and has very low operating costs and a very long operating life, why can’t an investment case be made in a market with internationally high power prices? Is it a problem with the technology or the market design?

Over to you Dr Schott.

[1] A strong argument can be made that electricity supply is not improved by the application of certain types of market structures (such as those found in parts of the US, Australia, UK etc.) and that reconfigured Government utilities may achieve better public interest outcomes; however, I will leave this for a future article.

[2] Financialisaton in this context describes the rise of market instruments (also referred to as synthetic) and trading activity as a layer on top of the infrastructure. Power systems can be effectively operated (though not always efficiently) without the layer of market instruments and energy trading. The market instruments and trading activities are not required for the supply of electricity and impose an additional cost. If this additional cost is less than the efficiency improvements achieved through the introduction of the market, then financialisation can be beneficial.

[3] Levelised Cost of Electricity (LCOE) quantifies the all-in cost of power at the generating station’s metering terminals, minus capital recovery. LCOE was a useful metric to assess the cost competitiveness of a generation technology when all generators had similar availability and dispatchability attributes. With the rise of intermittent renewable energy which does not have these attributes to the same degree, LCOE has become a meaningless metric (the proverbial comparison of apples and oranges). However, LCOE is still often used by renewable energy advocates who point to the very low LCOE of wind and solar when claiming renewables are now cheaper than all other sources of power. Serious energy policy now uses System Levelised Cost of Electricity (S-LCOE) to reflect the costs of intermittency and other externalised costs of renewable energy not borne by renewable investors.

[4] Interested non-technical readers should refer to Meredith Angwin’s Shorting the Grid which is the best non-technical description I have read of how network operators ensure grid availability of greater than 99.99%.

Download this article here:

Why don’t we demand Zero Emissions Always On Affordable Power

Paul Kristensen

Posted at 18:57h, 18 JanuaryExcellent summary of the main, self-created barriers against the introduction of nuclear power plants in Australia. If anyone had set out to make a mess of our power supply, they could hardly have achieved a greater success.

The problem is the design of the market that we currently have in Australia. Clearly, a sensible redesign is both imperative and urgent.

So, how might such a change be achieved against the now massive vested interests that have come to dominate our power system? That is an issue I have no solution for.

James Fleay

Posted at 13:26h, 24 JanuaryHi Paul,

Thanks for taking the time to comment. I regularly find myself cursing the vested interests you refer to and I agree they are not above criticism. However, I have to remind myself that state and federal governments created the liberalised power market with substantial Government support for a particular type of technology, and big energy businesses are simply doing what could be expected of any rational actor who bears no responsibility for the performance of the power system with respect to price, reliability and emissions.

It will take a politically courageous Government to acknowledge that our current market approach has been flawed from the start and that outsourcing power system long-range planning to the market borders on an abdication of responsibility.

Thanks again for your comment.

Kenneth Charles Muir

Posted at 19:38h, 18 JanuaryHello Rob

A case of preaching to the choir when you write to electrical engineers from the power industry. (Interested how you acquired my email address). In other words I totally support your drawing attention to SCoE, the only thing that matters. The IEA’s 2020 cost of generation report is a good read on the theme, if you haven’t already done so. It rather damns the use of LCoE as a metric by faint praise and has come up with VaLCoE – the declining value of VRE to the system as its share increases. SCoE appears a bit more straightforward but VaLCoE might raise some sensible questions for VRE.

And indeed the energy close out price approach of the NEM warrants a hard eye’s review. Arguably it only worked for so long due to the excess firm capacity in the NEM from when this market approach started till relatively recently (and the tiny role of VRE at that time).

VRE has a place in the optimal technology mix, but how big needs rigorous study.

Regards

James Fleay

Posted at 13:33h, 24 JanuaryHi Kenneth,

Thanks for taking the time to comment. I have recently read the GENCOST report and you have nailed their position on LCOE.

The take away for me was that calculating VaLCoE using their method can only be done on a system-by-system basis, giving regards to market size, market type, incumbent generation, geography, climate etc. We’ve trawled through the academic literature to try and find some simple “factors” to estimate the gap between LCOE and S-LCOE in the NEM with regards intermittent supply but we’ve been unable to find anything. OECD, MIT and others have done excellent work but the simplified factors we’ve look for don’t exist and the GENCOST report describes why this is the case.

I agree that VRE has a role in the technology mix but that this falls short of 100% renewable energy.

Thanks again for your comment.

Peter Farley

Posted at 01:09h, 19 JanuaryThe problem with this argument is that no-one has ever built an always on power generator. Even the much lauded AP1400 has a design availability of 90% and while some reactors have achieved better than that for some years, none have achieved it over their life and some very much worse. In fact 5 or Swiss reactors were offline at once a few years ago

Then there is the problem that demand varies. In the past France was generally acknowledged as the best operator of Nuclear plants, but their best utilisation was 75% because they cannot use all the power at night or weekends even though they export significant quantities of power to Italy, Spain and others at night so those countries can scale back their gas and hydro generators. The US manages about 92% utilisation, because nuclear supplies less than 20% of annual generation so nuclear is always far less than minimum demand.

Now Australia has three further complications,

1. Australia can’t export excess power or like France or the US, import at peak system demand, so Australia must have more peak capacity, which is rarely used. Even if that peak capacity is pumped hydro, it has to be built and by definition it will only run flat out two or three times a year or, in a summer like this, the last 10% of capacity will not be used, but will still add to system costs

2. Demand is more variable. NEM demand varies from 16.5 to 36 GW. Victorian demand varies from 2.2 GW to 9.4 GW and South Australia from 380 MW to 3,400 MW. How does an always on nuclear system cope with that. It doesn’t without a lot of storage

3. SMRs are not yet realistic, they have been promised for 50 years. In the 80’s they were 4 years away. Now they are 10-12 years away so if we want nuclear we will have to go with GEN III large plants. The only Western company willing to take an order for a GEN III plant that has actually been built is EDF. Toshiba Westinghouse has withdrawn from new plant construction. Korea has legislated to stop building nuclear and the GE Hitachi JV has yet to receive an order.

The EPR is 1.6 GW therefore a single unit must have at least 1.6 GW of spinning reserves in case of a trip and 1.6 GW long term generation for at least 6 weeks every three years for refuelling. 1.6 GW of spinning reserve does not mean 1.6 GW of gas for example it means hot running gas at 20-30% capacity and at least 14,000 MWs of inertia so that if the plant trips the grid does not crash. So SA needs to maintain at least 2 GW of gas on line all the time running at 20-30% of capacity and install a large number of syncons/pumped hydro as well to match the inertia of the nuclear plant. The problem then is that SA will be generating at least 1.6 GW of power all the time when demand often falls as low as 500-600 MW. What will it do with the extra power. Will it build two new export transmission lines and hope other states need power, when SA doesn’t, will it build 1,000 MW x 36 hours of pumped hydro or will it skip nuclear. Because even with the pumped hydro it will still have to export half the power it generates. It will still have to have 3.4 GW of alternative dispatchable capacity on the reasonable assumption that every two or three years there will be at least a 20% chance that the nuclear plant is offline in hot weather

Similar calculations apply to the SWIS, Tasmanian and North Queensland grids so we are left with SE Queensland, the Hunter Valley and the Latrobe Valley as the only places where an EPR nuclear reactor could be installed without requiring significant expansion of transmission and backup. So lets see how they would fare there.

Let us make the heroic assumption that the APR 1400 could be built for the same price in Australia as it is in Korea, when we do not have the facilities or experience to do it. allowing for inflation since the Barrakah order was signed and this is two units not four, a pair of 1,345 MW generators could possibly be built for about A$18 bn and at rated capacity and duty cycle of 85% (two reactors + spinning reserve would often be more than Victoria’s demand) the reactors would generate 20,000 GWh per year, about half Victoria’s annual grid demand. Again about 3 GW of gas and hydro would still be required in case one tripped while the other was being maintained.

Alternatively at current costs we could distribute 3 GW of wind plants around the state, add 2 GW of 100-300 MW solar plants and 5 GW of rooftop solar. Now because wind + solar is never zero at peak demand, it will actually need less peak backup than the nuclear plant to guarantee 2.7 GW of power. Also as the sun shines every day and the wind blows every hour, the duration of the backup will be less than for a two unit nuclear plant, but for simplicity lets assume that the backup is the same. There will also be times where wind and solar generates more than is needed so assume we need to curtail 15% of the wind and solar so we should up the capacity to 3.3 GW of wind 2 GW of tracking solar and 5 GW of rooftop. At modern capacity factors of 45%, 28% and 14% respectively that will provide 20,000 GWh per year even after 15% curtailment. The cost of the wind+ solar generation will be about $14 bn for the same annual output. The kicker is that the wind and solar system will have an operating cost of about $375 m per year, but at current costs (US$40/MWh) the nuclear system would have operating costs of almost $1.1 bn. If the process started today the whole wind solar system would be operating in three to four years. The nuclear plant wouldn’t even have turned the first sod.

James Fleay

Posted at 14:00h, 24 JanuaryHi Peter,

Thanks for taking the time to comment. I think you’ve raise some very valid points around NPP unit size and how this could work in the NEM. My instinct is that the optimal unit size for an NPP in Australia is probably less than 1 GW for the reasons you’ve described BUT a comprehensive system study that runs multiple scenarios would be needed. The same system study would also need to run the renewables-heavy alternative you’ve described as other high-VRE locations (i.e. California) are running into real supply adequacy issues. Baseload plants often run at a little less than 100% so that several of them in combination have sufficient incremental reserve margin to accommodate a trip of a single unit – indeed this is how power networks have always been managed. On this simple basis, 4-6 strategically located APR-1400 reactor pairs should present no challenges to network operators. Accommodating NPP re-fueling outages has not presented other power systems with supply adequacy challenges.

I can’t agree with your view on SMRs. I think some pro-nuclear people make the mistake of over-hyping the likely timelines for Gen IV reactors which are likely at least 15 years away because of the technology and fuel qualification processes. However, LWR SMRs are scaled down versions of mature designs with greatly reduced complexity and use existing fuel technology. There are at least two highly credible vendors advancing towards first deployment by mid decade. I think these designs (GE-Hitachi BWRX-300 and NuScale) should be considered as a prospective option for Australia.

Thanks again for your comment.

Peter Farley

Posted at 14:36h, 19 JanuaryOne other comment:

We seem to persist in the notion that we have a power crisis in this country. If we did power prices would be high and blackouts frequent. Neither is true.

Over the last 9 months power prices have been at or near their lowest prices since the NEM was commissioned. The only blackouts due to lack of supply that have occurred in the last three years have been associated with transmission failures not generation.

On Thursday 17th of December seven of sixteen NSW coal units and a transmission link to Victoria were offline simultaneously and yet still no load shedding. Prices shot up to $15,000/MWh briefly but spot prices financial year to date in NSW have still fallen to about $53.50, the lowest prices since 2015 and much lower than 19/20 average of almost $72

Engineer-Poet

Posted at 05:55h, 23 JanuaryThere are solutions to the problem of “too much power”, namely interruptible loads and dump loads. The refusal to consider them is a consequence of thinking of the grid as an isolated element, rather than part of a larger energy system. Plug-in vehicles make for good interruptible loads; every watt going into a charger can be used as spinning reserve. Plasma gasification of garbage makes a good dump load. It’s even feasible to dump electricity into electric heaters at conventional power plants, replacing fuel. It’s highly inefficient, but if you are using energy which has no emissions and zero marginal cost (which describes both WASPs and NPPs) you might as well.

Also, is there any chance of persuading the webmaster to stop setting ridiculously low-contrast text colors? The default is #000, and it’s clear and readable. What’s set for this text box is #3f3f3f, and it’s hard to read. Why do you mess with something that isn’t broken?

James Fleay

Posted at 14:12h, 24 JanuaryHi Colin,

Thanks for the comment. You’ve neatly captured some of the issues around Government interference with markets that I covered in my piece. I recently “attended” the IFNEC virtual conference “Financing New Nuclear” and the highly experienced presenters outlined that out-of-market subsidies are only part of the problem. The other part of the problem (and the reason for the high CfD strike price for Hinkley Point C (HPC)) is project completion risk and this is something that the nuclear industry must tackle head on (and it seems they are doing just that). It is unarguable that western nations nuclear project performance in the last 20 yrs has been truly awful and there will need to be evidence of improvement if investors are to dip their toes back in the water.

Thankfully, the reasons for NPP poor performance in the west since 2000 are well understood, can be remedied and are actively being worked on by SMR vendors in consultation with tier 1 engineering houses. Whilst we wait to see the project performance of HPC and the first SMR projects, we must take steps to be ready to deploy these technologies if they perform well during the project phase. A very low cost action that the federal Government could consider would be the appointment of a NEPIO (see IAEA website) which would cost nearly nothing but have very large option value in 3-5 yrs time.